Zoom shares rose as much as 13% in extended trading on Monday after the video chat software vendor announced fiscal fourth-quarter results that topped analysts' expectations.

Here's how the company did, compared with consensus among analysts polled by LSEG:

Earnings per share: $1.22, adjusted vs. $1.15 expectedRevenue: $1.15 billion vs. $1.13 billion expectedRevenue increased less than 3% from $1.12 billion a year earlier, according to a statement. The company reported net income of $298.8 million, or 98 cents per share, for the quarter ended Jan. 31, compared with a net loss of $104.1 million, or 36 cents per share, in the year-ago quarter.

Far from its heyday during the Covid pandemic, when a surge in the number of remote workers sent revenue up over 100% for five straight quarters, Zoom is now mired in single-digit growth.

For the fiscal first quarter, Zoom called for $1.18 to $1.20 in adjusted earnings per share on $1.125 billion in revenue, which would represent growth of less than 2% from a year earlier. Analysts surveyed by LSEG were looking for $1.13 in adjusted earnings per share and $1.13 billion in revenue.

For the 2025 fiscal year, Zoom sees $4.85 to $4.88 in adjusted earnings per share, with $4.60 billion in revenue, implying 1.7% revenue growth. The LSEG consensus was adjusted earnings of $4.71 per share and revenue of $4.65 billion.

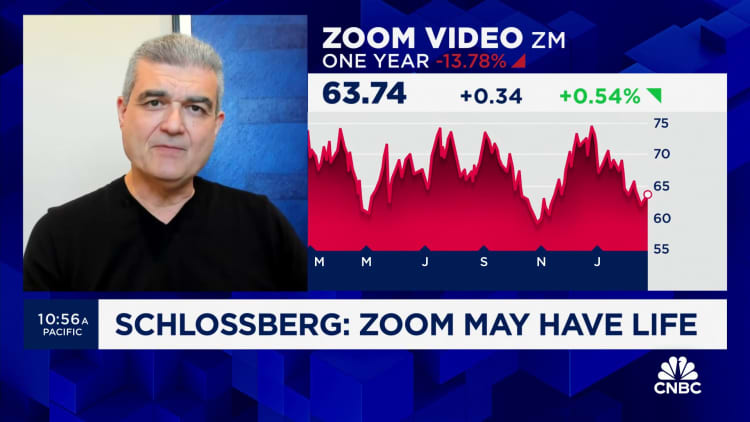

Before the jump, Zoom shares were down 12% so far this year, while the S&P 500 stock index had gained 6% over the same period.

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

This is breaking news. Please check back for updates.

WATCH: Boris Schlossberg on Zoom: 'It has a chance to really shine going forward'

.png)

English (United States) ·

English (United States) ·  Turkish (Turkey) ·

Turkish (Turkey) ·